The Best Time to Switch Your Auto Insurance Provider

The Best Time to Switch Your Auto Insurance Provider

Blog Article

Optimize Your Tranquility of Mind With the Right Automobile Insurance Coverage Plan

Browsing the intricacies of vehicle insurance coverage can typically feel frustrating, yet it is crucial for ensuring your comfort on the road. By understanding the numerous sorts of protection readily available and examining your individual demands, you can make informed choices that align with your way of living and budget plan. The process of contrasting service providers and recognizing prospective price cuts can lead to considerable financial savings. The most reliable strategies for customizing your auto insurance coverage plan may not be immediately apparent-- this conversation will reveal important understandings that might change your method to insurance coverage.

Understanding Vehicle Insurance Policy Fundamentals

Understanding the fundamentals of automobile insurance policy is necessary for each vehicle proprietor. Vehicle insurance offers as a financial security net, protecting people from potential losses resulting from accidents, burglary, or damage to their automobiles. At its core, vehicle insurance coverage is consisted of different insurance coverage types, each designed to address certain threats and obligations.

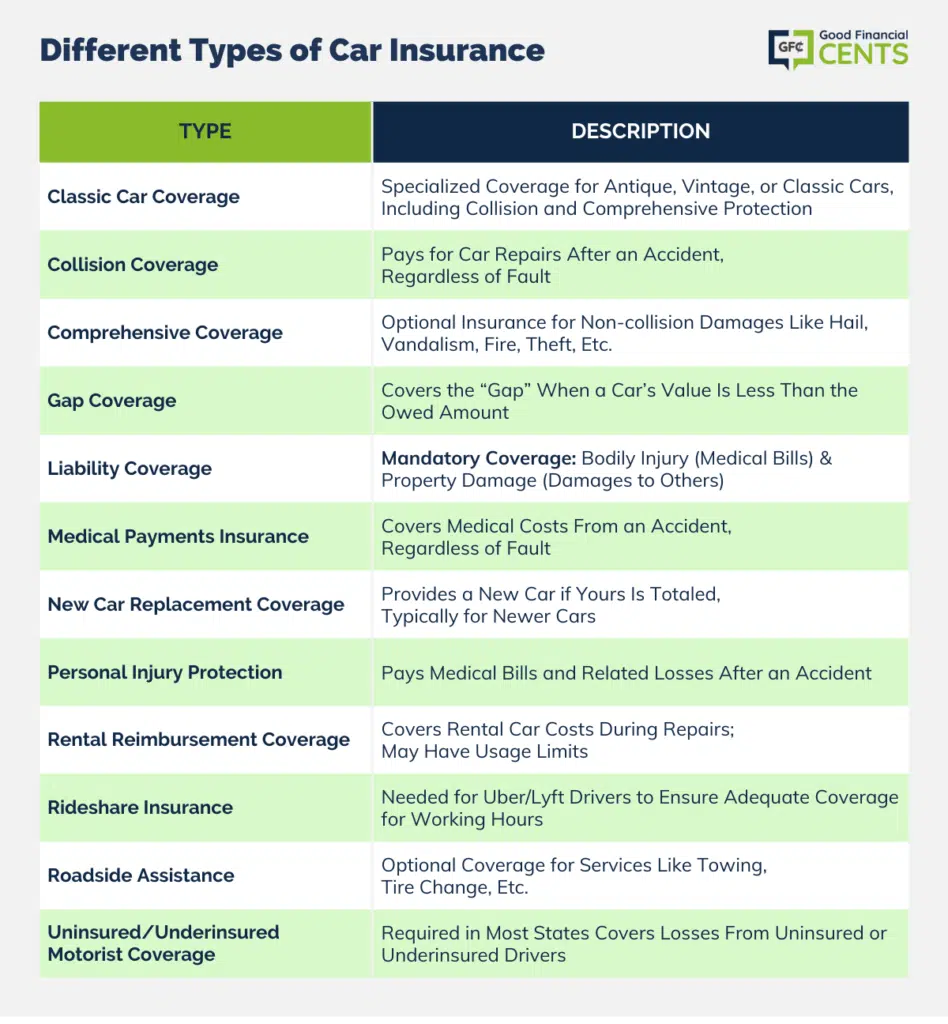

The primary elements include responsibility protection, which safeguards against damages inflicted on others in a crash; collision coverage, which pays for fixings to your lorry after a collision; and detailed insurance coverage, which covers non-collision-related occurrences such as theft or natural calamities. In addition, several plans provide accident protection (PIP) or uninsured/underinsured vehicle driver protection, which can supply vital assistance in the event of a crash with an at-fault chauffeur who lacks sufficient insurance.

Costs for automobile insurance coverage are affected by a multitude of aspects, including the chauffeur's history, the kind of vehicle, and regional laws. Understanding these essentials furnishes lorry owners to navigate the complexities of their plans, inevitably resulting in informed decisions that line up with their distinct requirements and situations.

Analyzing Your Insurance Coverage Demands

When identifying the ideal auto insurance protection, it is essential to review individual circumstances and danger factors. Comprehending your driving routines, the kind of automobile you own, and your monetary situation plays a considerable role in choosing the right policy.

Regular commuters or those who often drive in high-traffic locations may call for more detailed protection than periodic drivers. Newer or high-value automobiles usually benefit from collision and comprehensive insurance coverage, while older vehicles may only call for liability insurance coverage.

Furthermore, your personal properties should be taken into consideration. Higher obligation limitations might be essential to shield them in instance of a crash if you possess substantial assets. Reflect on your convenience degree with danger. Some people prefer to pay higher costs for included peace of mind, while others may choose marginal protection to save money.

Contrasting Insurance Policy Service Providers

Following, think about the series of insurance coverage choices each company offers. Try to find plans that align with your certain needs, consisting of obligation, collision, thorough, and without insurance motorist insurance coverage. Additionally, check out any type of readily available add-ons, such as roadside assistance or rental vehicle reimbursement, which can boost your policy.

Pricing is another essential variable. Obtain quotes from numerous service providers to recognize the price differences and the insurance coverage used at each price factor. Recognize the limits and deductibles connected with each plan, as these factors dramatically affect your out-of-pocket expenditures in the event of a case.

Lastly, analyze the insurance claims process of each company. An uncomplicated, reliable claims treatment can greatly influence your general satisfaction with your vehicle insurance policy experience.

Tips for Reducing Premiums

Numerous motorists aspire to discover ways to lower their auto insurance coverage premiums without giving up necessary coverage. One reliable strategy is to raise your insurance deductible. By going with a greater deductible, you can substantially decrease your month-to-month premium; nevertheless, guarantee that you can comfortably manage the out-of-pocket expense in instance of a case.

An additional approach is to make use of discount rates offered by insurance companies. Numerous firms give savings for factors such as secure driving documents, packing numerous plans, or having specific safety functions in your car. Constantly ask about readily available discounts when acquiring quotes.

Maintaining a good credit rating can likewise result in lower costs, as many insurance firms think about credit rating history when identifying rates. On a regular basis evaluating your credit scores report and dealing with any type of inconsistencies can aid boost your score with time.

Lastly, think about the sort of automobile you drive. Vehicles that are less expensive to repair or have greater security rankings commonly come with reduced insurance expenses. By examining your automobile choice and making notified decisions, you can properly handle your vehicle insurance coverage expenses while making certain sufficient insurance coverage continues to be intact.

Evaluating and Upgrading Your Policy

Regularly evaluating and upgrading your auto insurance coverage is important to guarantee that your insurance coverage lines up with your present requirements and scenarios. auto insurance. Life changes, such as buying a new automobile, relocating to a different place, or adjustments in your driving habits, can significantly impact your insurance needs

Begin by analyzing your existing insurance coverage limits and deductibles. You may want to readjust your crash and thorough coverage accordingly if your vehicle's worth has decreased. Furthermore, consider any new discounts you might certify for, such as those for safe driving or packing plans.

It's additionally sensible to evaluate your personal circumstance. If you have actually experienced considerable life occasions-- like This Site marital relationship or the birth of a kid-- these might call for an upgrade to your policy. If you have actually embraced a remote work arrangement, your daily commute may have transformed, possibly affecting your insurance coverage needs.

Lastly, consult your insurance company at least annually to discuss any kind of modifications in prices or coverage alternatives. By taking these aggressive steps, you can guarantee that your auto insurance plan offers the best defense for your progressing way of living.

Conclusion

To conclude, choosing the suitable auto insurance policy plan calls for a comprehensive understanding of protection types and try this site careful examination of specific requirements. By comparing different insurance service providers and proactively seeking discounts, insurance holders can achieve an equilibrium between ample security and price. On a regular basis evaluating and upgrading the policy makes sure continued significance to transforming situations. Inevitably, a well-chosen automobile insurance plan offers to enhance comfort, giving both financial safety and self-confidence while navigating the roadways.

The most reliable strategies for tailoring your car insurance coverage strategy might not be quickly apparent-- this discussion will uncover important insights that might transform your technique to protection.

In the procedure of choosing an automobile insurance coverage company, it is necessary to carry out a complete comparison to ensure you find the ideal coverage for your requirements - auto insurance. By reviewing your car option and making informed choices, you can properly official site handle your car insurance expenses while making certain appropriate protection remains undamaged

In final thought, selecting the ideal automobile insurance coverage plan calls for a complete understanding of protection kinds and cautious assessment of specific requirements.

Report this page